This fintech takes tax refunds to the next level with their partnerships with airlines

By Jim James, Founder EASTWEST PR and Host of The UnNoticed Entrepreneur.

Ameer Jumhaboy and his father founded a business called UTU. They’re using partnerships to help build a global tax refund brand. In the new episode of The UnNoticed Entrepreneur, he joined me all the way from Singapore (where I first met him as a kid) to talk about their company.

Image from LinkedIn

What UTU Offers

Ameer’s father has 25 years of experience in this space. And during the episode, he pointed out that the problems in the industry today are primarily around the fact that tourists only get about half the refund that they expect to receive. They are trying to solve this specific problem by making sure that they’re putting more money back in the pockets of customers.

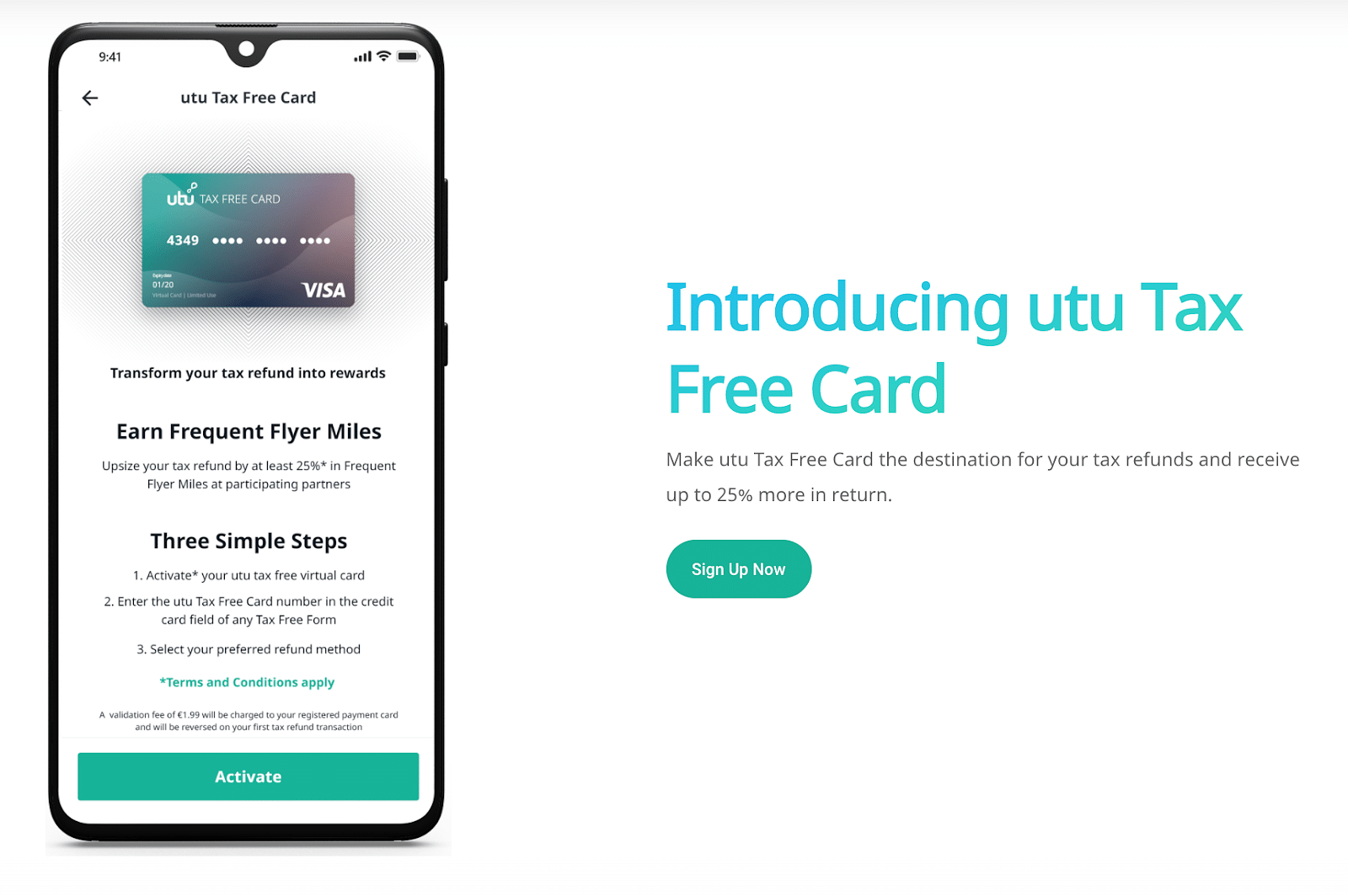

The way they’ve done that is through a product that they recently launched: the world’s first tax-free card.

Here’s how it works: For instance, you travel to France. Usually, you pay for a handbag with your American Express card or Visa card issued by your local bank. But when you choose how you want to receive the refund, you can stick in UTU’s card number and that will allow you to upsize the value of your refund by 25%. If the original refund is €240, their card can give you €300 if you choose to take it in the form of a reward from any of their partners. These include some of the world’s leading airlines such as Emirates and Singapore Airlines.

Screengrab from UTU

Serving the Same Customers

How do they get consumers to get hold of the UTU card? Ameer said that it’s through partnerships.

What the last couple of years have done to the travel-related industry is to realign the values of big corporations and fantastic hard products like what Emirates, Singapore Airlines, and Ethiopian Airlines have with what small financial technology (fintech) companies like UTU do.

At the end of the day, these companies are all serving the same customers. They may be dancing different dances but it’s all about fairness; it’s about giving people delightful experiences and value on their travel and increasing that value.

When you find these commonalities, people can come together around the table and say, “Look, the traveler is going on a journey. They’re flying your airline. We’re a tax-free operator. How can we sort of meld our brand offerings to provide a more delightful experience?” At UTU, they’re doing that by rewarding airline miles.

Ameer said that they’re pleased and proud of all their partners. But talking about their big airline partners, one thing that he’s very humbled by is how well these companies have taken their proposition. This goes back to what he was saying about the value in what they are able to offer to the same customers.

Getting Partners Aboard

There are many tax-free solutions today. To some degree, UTU, which is a small fintech company, is a disruptor. How did they encourage such big airline brands to work with them rather than their more established competitors?

The airline industry, in particular, is very interesting because airlines have never really been traditional players in the tax refund industry. Historically, the tax refund industry has been a very business-to-business (B2B) industry. Over the last few years, it has seen some business-to-consumers (B2C) players coming in, including UTU themselves.

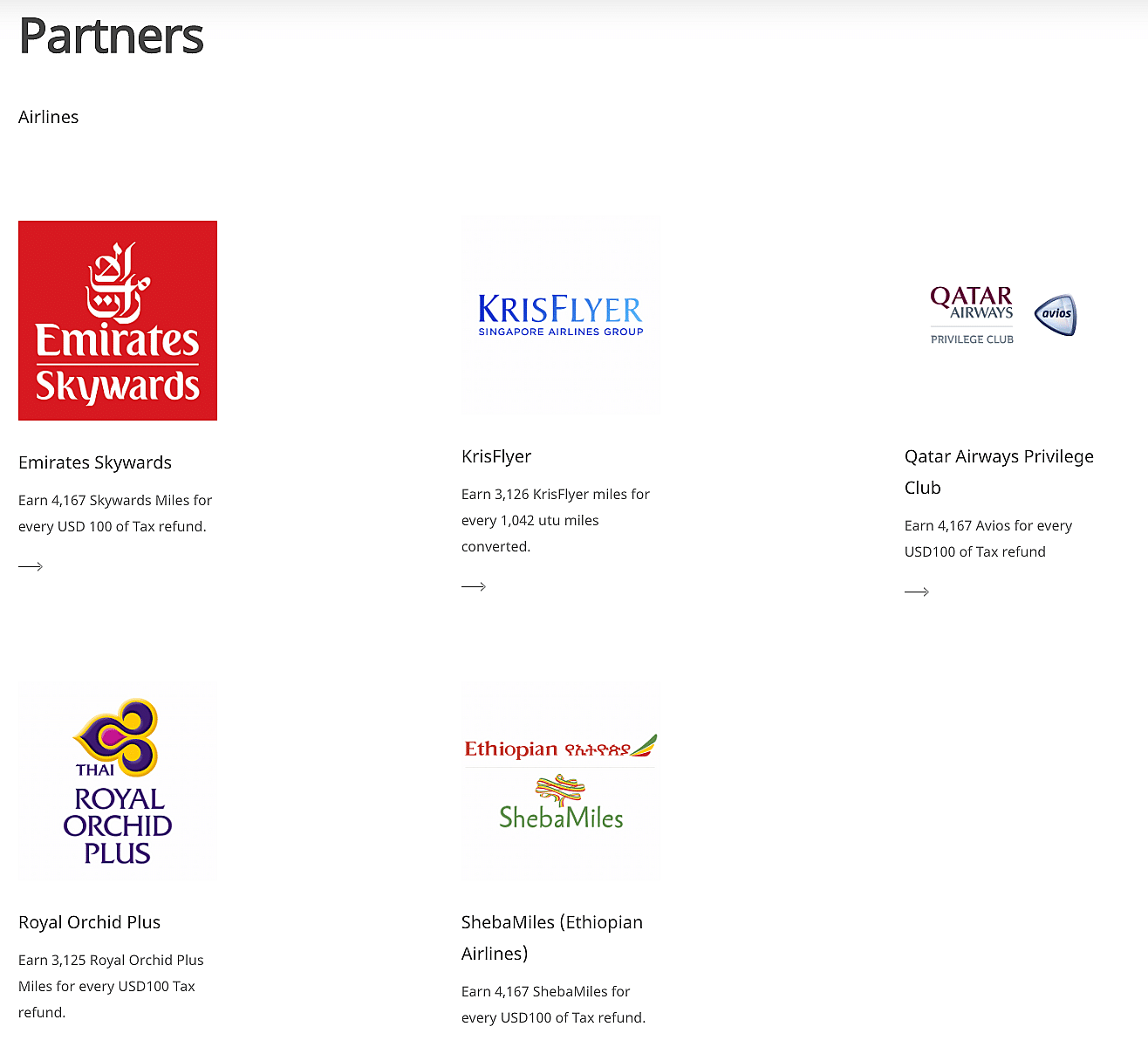

Screengrab from UTU

However, the way UTU has started thinking about what a tax refund is, is very different from most people.

According to Ameer, they think of a tax refund as a tax reward. It’s an incentive provided by governments to encourage spending in their countries to help boost tourism multiplier by increasing exports. The whole premise is to turn the individual tourists into individual exporters. What they’re essentially saying is that it’s really a question of rewarding spending. It’s an incentive.

For instance, when you shop, you can get rewards through your Barclays card. You can use those Barclays points to get coffee from Starbucks. But, if you shop in a particular government’s country, they can reward you way above that refund. It really is a country reward.

If you look at what the airlines have been able to do in the last couple of years, many of them have created a really interesting ecosystem — wherein those points have started to become an experiential modality of transaction. Today, you can use Emirates Skywards miles to redeem football tickets, for example. It’s not just about the airlines anymore. It’s about creating delightful experiences.

When UTU spoke to the airlines, they learned that these airlines want to create such experiences in their wide realm. And Ameer and company help to create that in a very specific realm that they know very well. And so these airlines are very happy to work with them.

Going back to economic theory, you have to do things that you’re good at — the things that you can specialise in. At UTU, they are tax refund specialists. And that’s a gap that they can help to plug in the airline while also allowing them to participate in the global tourism retail ecosystem.

Getting Customers Aboard

UTU works with airlines who have become advocates of sorts of the company’s tax refund system. The question is, how do they help airlines explain to customers about the proposition they’re offering, which is about getting the most of their tax refunds?

For Ameer, one of the things that they’re very blessed with is that all of their airline partners have extremely loyal customer bases. With that, you have a great sense of trust. Customers have a great sense of security in the brand that they’ve been loyal to for so many years.

But now, UTU is going beyond loyalty.

They’re trying to basically convey their value proposition in a way that people can understand a little bit easier — because the tax refund industry has been very opaque for many years. Today, you have so much information at your fingertips. Yet, there’s still very little information that you can find about where your refund is going, how you are losing up to half of your refund, and who does it go to?

What they’re doing at UTU is to try to unpack a little bit of that opaqueness and tell the user, “Look, it’s not about losing half the refund. It’s actually about helping you receive more. It’s about giving it back and putting it into your pocket.”

Image from Unsplash

Ameer thinks that this resonates very well and easily with people because there are two common complaints he gets about tax refunds. First, the lines in the airports are very long (which he believes can be solved through digitisation). Second, the customers just want to know what happened to their refunds.

UTU helps provide a little bit of these nuggets of information. And a great way to do that is by getting people used to the idea that a tax refund is actually a country reward and it can be received in the form of airline miles.

This is not just about getting the message of their airline partners to their users and customer base. But it’s also about finding a way to meld that with UTU’s simple message: When you’re shopping or you’re flying your favourite airline, this is the one tax-free card you need to get more back in the loyalty program that you love.

For the airlines and their other partners, it’s really enhancing their customer experience as well.

On Digitisation and Tapping the Power of Mobile

This is what Ameer loves about technology: it keeps you on your toes. The things that you can do today in 2022 are things you couldn’t have done in 2020 or 2019, which was just before the pandemic.

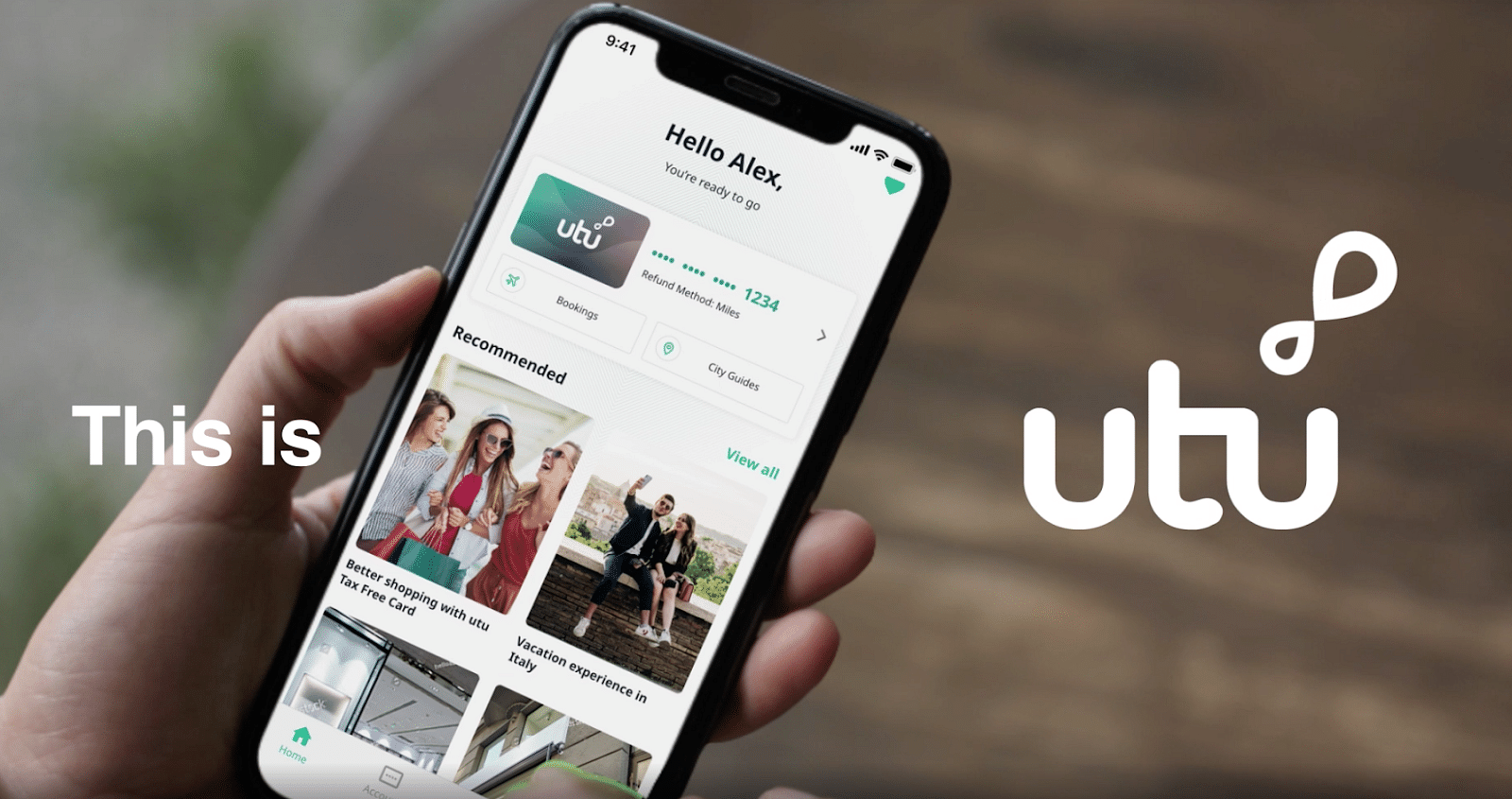

Over the last two years, which have not been the easiest couple of years for UTU, they’ve tried to leverage the best of mobile technology to understand these things: On the customer journey, what are some of the key issues that people face? How can they use the power of mobile phones to solve these? Can customers submit tax invoices by taking a picture? Is it possible to start issuing virtual cards on the mobile so customers won’t have to go to the bank and line up to do that?

Some great fintechs have come out of the UK and they’ve shown the way to do that. And what they at UTU are trying is to do that in their own way.

According to Ameer, the power of mobile technology today has significantly cut a lot of friction in their industry — and that the digitisation will always continue. But the real key for them is how to combine the power of the phone with mental gymnastics around their business model. He’s most proud of his company for being able to ideate this concept of the country reward.

Image from Unsplash

The Importance of Emotional Connection

With technology, you’ve got a direct connection to the user and the shopper. But it can be an opportunity for confusion if both UTU and their partners explain the processes of their offering at the same time.

For Ameer, it’s really about firstly getting an emotional connection with a potential customer. And their partners have been incredibly helpful in getting that part going.

Once people have been brought in on the emotional side (wherein they’d say, “Hey, I want to get my refund upsized in the form of a reward of my choice”), the next phase is to explain how that actually happens. And that’s where their side — where their app — takes over.

It’s really about the emotional hook first. It needs to be an emotional hook that’s customer-centric, fair, and adds significant value to the tourist journey. Then, they go a little bit more of the nitty-gritty on the app.

How do they actually issue the card? What is the KYC (Know Your Customer) process? This is important because they’re issuing cards all around the globe. It’s not just as straightforward as issuing it domestically. How do you get a global card out? How do you onboard the customer? How do you explain to them how this card works? Because this is a new paradigm shift in the way that people think about this industry. It’s a niche industry and it’s actually quite a large one because the impact that it could have on tourism-based economies could theoretically be huge. What UTU is really after is to drive the country’s economies as we come out of this pandemic.

Addressing Different Audiences

In their industry, they’re addressing two different audiences — one who travels for vacation once or twice a year and one who’s on business travel who flies maybe once a month.

Business travelers are on a tight schedule and are often in a rush. Many of them actually don’t end up doing the refund because they’re constantly on the move. Leisure travelers, on the other hand, have a great holiday and they’re often stuck with a refund process that doesn’t really do any favour for them about the money that rightfully belongs to them.

When it comes to their messaging, UTU is trying to be that ubiquitous and household name when you want to shop tax-free. No matter who the operator is, no matter what shop, no matter which country that does a tax refund shopping system, you want to be using UTU to upsize your refund.

Image from Unsplash

When you think of ride-hailing, you think of Uber. When you think of the new way of doing a foreign exchange, you think of Revolut. If you look at what it’s like pre-pandemic, what did you take when you travelled? You took your leather wallet with your physical cards, a traveller’s cheque if you’re coming from some country, and then your physical passport. Today, you have your photo on your phone, you’ve got Revolut, you’ve got KAYAK for your flights, and you’ve got UTU for your tax-free rewards.

It’s a direct-to-consumer proposition. It’s about putting customers at the centre of transactions — giving them more of the money that rightfully belongs to them and bringing power, choice, and control to the end tourists. It’s really about redefining an experience and doing it on a fairly large scale across 50 countries.

How Were They Able to Acquire Partners in the First Place?

Talking about the acquisition of partners, Ameer shared that they hustled especially at the beginning.

They had this great idea to refund in air miles and upsize people’s refunds. Yet they didn’t know how to reach the airlines. What they did is to send cold emails to a couple of airlines and they got a response from their first partner, which was Emirates. They had a really great ideation session with them. They love the proposition and they became partners.

Once Emirates joined, there was a little bit of FOMO or fear of missing out that happened. But a lot of other airlines more importantly saw the tremendous opportunity. In many cases, a Singapore Airlines customer may not necessarily be a ShebaMiles Ethiopian Airlines customer. So you have very unique user groups. There’s not really much of a bleed between the airlines. Everybody was happy to jump on as they see the great benefit that UTU can provide to their customer base.

Amee considers themselves lucky to start with these first few partnerships, which is what you can see on their app today: Thai Airways, Ethiopian Airlines, Singapore Airlines, Emirates, and Qatar Airways. They’ve also got a few more airlines coming on board later this year. And every single one of them believes in this customer-centricity.

In the beginning, it was that entrepreneurial hustle of just going through LinkedIn and reaching out, cold emailing, and cold calling. Some great people pick up, you have a great conversation with them, and off you go.

While it’s a big business proposition, it’s still a very personal pitch. Ameer said that he’s always held this long-standing belief that business is really done between people. And it’s about that human connection and getting people to buy into your story and you buying into their story.

He loves this kind of connection because the moment that the values align, it creates really great chemistry. And out of that chemistry comes great products and services that delight millions of people worldwide. For Ameer, this is the beauty of what the internet age has especially been able to do.

The ‘Now’ and The Way Forward

In October last year, UTU launched their tax-free card in 50 countries. Then, the COVID-19 Omicron variant happened. They haven’t put very much into marketing at all, but they currently have low five figures in terms of active users. And they’re very happy with the number of transactions that have been going on.

Screengrab from UTU

What Ameer is most happy about is that the majority of their active users have actually chosen to be refunded in an upsized airline miles refund. The most important thing is that the thesis of country rewards is really starting to come to fruition.

For them, it’s now about taking things to the next step: Now that the UTU card can be used as upsizer across the world, can they actually start to go into different countries as a full-fledged refund operation and start offering even more value on the ground? And this is something that customers can see from summer.

Their card is essentially a Visa card. As long as you send your refund to that card, they will be able to provide you with that upsize. When he talked about going into a country, he meant having a connection with the customs of that country. With that, they can start to handle the refunds within the country itself and not just upsize the refund from other operators as they currently do.

It’s now a matter of the disruption coming into the infrastructure of the tax refund system. And to start doing that, they’re going to come to some of the largest markets in the world for tax refunding over the summer.

A Challenging and Exciting Endeavour

Ameer considers it very exciting to be able to redefine a user experience. But it’s challenging at the same time because people have been used to doing tax refunds in a certain way for many years now. To unlearn some of these behaviours is not so easy.

However, unlike many other internet companies, UTU doesn’t have too many repeat customers. Tourists coming from Asia to Europe, for example, only travel once every two or three years. In some cases, there are outliers who come multiple times a year. But for the most part, they have a new tourist every day. It’s incredibly challenging to have to teach somebody a new way of doing things every day.

Nonetheless, as he looks at the younger generation and as they travel more, they get more into experiential journeys of sorts. This provides a tremendous opportunity because everybody today is after value. The pandemic has shown us that customer centricity is so important.

If you’re planning to travel in the summer, download and activate your UTU card and use it to receive a refund. They are also on their partners’ websites. If you’re a frequent flyer of any of their partners, you can check UTU out on their website, learn about the kinds of promotions that they have and see what kind of value that they can deliver to you for your next tax-free purchase.

This article is based on a transcript from my podcast The UnNoticed Entrepreneur, you can listen here.

Cover image by Nils Nedel on Unsplash