With proper market research and analysis, you can successfully grow your business in this ‘age of narrow’

By Jim James, Founder EASTWEST PR and Host of The UnNoticed Entrepreneur.

Sean Campbell is the Founder and Chief Executive Officer (CEO) of business-to-business market research firm Cascade Insights, and he’s been an entrepreneur for over 20 years now. In the latest episode of The UnNoticed Entrepreneur, he talked about his concept, the “Age of Narrow,” and how it impacts a company or an entrepreneur who wants to get noticed.

Image from LinkedIn

Positioning Yourself in The Age of Narrow

For a lot of companies, the most important thing that they can do is focus on how they position themselves. A number of them initially focus on how they can produce good content and how they can reach out to customers — activities that require muscle. On the other hand, positioning requires you to use your head. And its primary goal is to figure out: Where in this marketplace should I stick myself? How should I define myself?

However, one problem is that many companies’ positioning is fairly broad.

His idea about the “Age of Narrow” came up when he was a fairly young seller having a conversation with a client who was then a Vice President (VP) at HP (now, he’s a VP at SAP). He was in his office, telling him about the things that his business does. He then said, “I know you want to keep the aperture wide open, but I need to know what you really do.”

It was a rather odd question for him to hear because he thought — why would he need to narrow his business down when it was doing all these things well?

In the back of his mind, he knew that there was something to learn from that conversation. After a while, he realised that there’s a lot of truth to the idea of not just limiting the aperture, but also taking one step further by telling the market what you don’t do.

Image from Unsplash

A few may advise otherwise. For instance, somebody in the venture capitalists community may say that you should tell the world everything you can do and all the possibilities of your offering.

However, the problem with it is that people want narrow stuff these days. We want to watch a fairly narrow Netflix queue — whether it’s British period dramas or Russian sci-fi that you like, you can watch that for the rest of your life.

Taking Transparency to a Higher Notch

That desire for narrow things is just one leg of the stool of the “Age of Narrow.” The other leg is that when it comes to content, we kind of don’t trust it anymore. We worry about fake reviews. We go to a media entity that we like because the other one is wrong. And we have this feeling that marketing — though it has educated us — has also always lied to us to some degree. It left us feeling that we were not hearing the whole truth.

One could even say that marketing has gotten a little bit more forthright. However, one thing that marketing has never really done is to say, “This is what we don’t do.” And this is the final leg of the “Age of Narrow” concept: You need to be able to tell the market what you don’t do. There are markets you don’t serve and there are capabilities you don’t have.

However, Sean is not talking about limiting yourself forever. Instead, it’s about wanting to create a degree of trust with the market by telling them in advance where your capabilities stop today.

From the research that his business has done and from observations of their own clients, he can empirically say that people actually love it. Because when they come to you, they don’t have to go search for that negative perception of you or your limits. And when they say search, they mean talking to a competitor or going to third-party sites.

Telling your limitations in advance is incredibly powerful. You will get more positive client reactions — and you will get clients who are more in your lane. You will no longer have these bad leads that are not exactly in the category that you want. All this will lead to a good boost in your return on investment (ROI) because you’re only closing leads that really matter.

Image from Unsplash

We, as consumers, also experience this. We sort our Amazon reviews from worst to best because we’re concerned about the quality of the products we’ll buy.

And, put simply, telling what you can’t do just makes you feel good. Because, at the end of the day, why not be direct and truthful with the market if it's going to bring all the rest of these benefits?

Keep in mind that it’s not about limiting yourself forever. It’s about defining your current state and saying, “I have fences on my business. I know where they are. And I want to explain to the market where those fences exist today.” Once you move those fences out, people will honour the fact that you’ve done that — and it’s partly because they trust where you put the fences initially. There will be a lot of virtuous goodness that comes out of that.

If you’d like to do some homework about this concept, you can start by looking at your competitors’ marketing and see if they’re saying anything about what they don’t do. You’ll probably find that it’s pretty limited and that leaves you an open lane to do something pretty differentiated and get noticed.

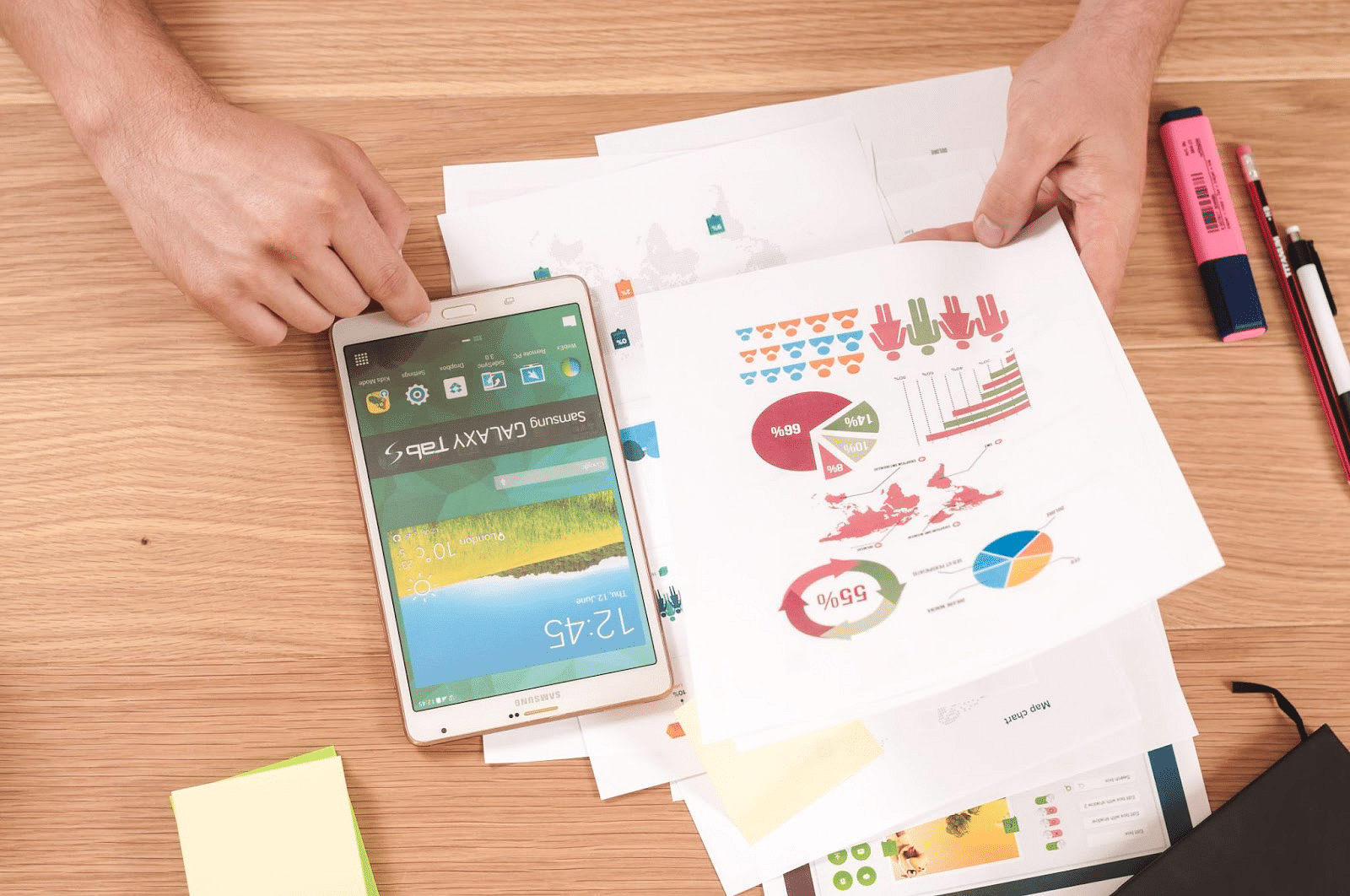

Determining Your Level of Narrow

To define what’s the appropriate level of narrow for your business, you can conduct market segmentation studies. You can do studies with buyers and do buyer persona research to figure out where the lanes are. You can do competitive landscape research to figure out if there's a gap between you and the competitive landscape that you should grow into.

A lot of these data are fairly discoverable. And they could come from having really meaningful conversations with buyers and prospects, and even competitors’ customers. Though you can hire businesses like Cascade Insights to do the research, a certain percentage of this can be done by yourself.

Instead of just meeting customer needs, have actual meaningful conversations with them about what they think the limits are of your offering, or what they think the competitive landscape looks like. You can do these things through a robust internal function.

Image from Unsplash

Research is important. The lack of it — combined with your desire to have your business reach all these potential areas — might lead you to make the bounds of your business a bit bigger than it should be in terms of your marketing and your sales efforts. From doing the research itself, you’ll get a good reality check.

Doing Research-Driven Content

As mentioned, people now don’t trust the content. But doing research-led content can help restore credibility, especially if it’s quantitative.

While qualitative research is powerful (When you do interviews or focus groups with a set of participants, it leads to a lot of discovery), doing quantitative research and building a series of content around it can help you have an authoritative tone from a thought leadership standpoint.

However, take note that there are a couple of downsides to it.

Quantitative research has a bit more of a floor you have to jump onto, expense-wise. If you’re conducting a survey, you need 100 to 500 participants for a third party to pick up on it. When you do a study like that, you also have to put your hands on the questions gently — and it’s more of an art than science.

President Thomas Jefferson once said, “Take things always by their smooth handle.” It's the same thing when you're thinking about designing the question set. You need to design the questions with forethought of, “I'd like the response to come back as something that other people would find interesting.” You have to structure the question in such a way that it would generate interest from a third party.

But, at the same time, if you grasp the questions too tightly, the whole study will lose its authenticity because it will be obvious that you were basically shifting the tone of the questioning so heavily.

For Sean, it's really a matter of keeping the truth to the truth. You can ask a question in a variety of ways, but the truth that comes out of the answer is still the same. It will all boil down to how you ask the question.

As a pro tip, he also shared that one way you can promote your studies is through the email subscriber list called HARO, which stands for Help A Reporter Out. It’s always looking for some data-driven story and it’s where you can go drop your insights in.

Building and Designing Surveys

For companies and entrepreneurs who are just dipping their toes in when it comes to research or who want to have their survey done on their own customer base, there are several quantitative survey tools available out there. There are higher-end ones like Qualtrics; there are fairly straightforward ones like Typeform and Momentive.

Your choice of tool really depends on how often you’re going to run a survey and how complex you want the survey logic to be.

Image from Unsplash

You can do a survey with minimal upfront investment from a tool standpoint. However, the real cost of a survey is the cost it gets to get the participants to participate — in other words, the incentives you use. The cost of just getting the participants initially can also be expensive, especially if you have a large enough customer base.

Another thing that you have to know is about standard response rates.

Many people are surprised about how these figures tend to be single-digit. Even if you’re giving an incentive or the audience you’re surveying already loves you, you may only end up getting a one-digit response rate from the total population where you sent your survey.

If you want to have 500 respondents, you should at least have a 5,000+ audience that you need to survey

Though it’s surprising, it’s just the way it is. You can address it by leaving your survey open for a longer time, providing a larger incentive, or hand-delivering the survey. There are a million ways to try to increase the response rate, but you're still going to need to gather a large number of potential participants before you actually get the ideal number of respondents.

And this is what tends to make surveys cost a lot. However, the results will be 100% powerful.

Image from Unsplash

In terms of the minimum number of questions, it will vary based on the audience you're going for. If you’re after consumers, the benchmark is around 20. After that, you will have a bit of a fall-off in the number of people completing the survey. And if they are your current customers, you’re just frustrating them.

Regarding that set of 20 questions, bear in mind that you’re going to lose five or seven of those to questions about demographics. Those questions are vital because you’d want to know details about your respondents (e.g. How many are CEOs? How many of them have used a competing solution?).

Knowing this, keep a mindset that you only have 10 to 15 meaty questions that you can ask.

Depending on your goals, there are different ways you can ask your questions and your question types. A good question budget to give yourself is to start with 10 questions that might be compelling. Then, see and extrapolate: If we ask the market this question, what will that look like as a number? What percentage of x will that be?

If you succeed in knowing that, you can end up with some fairly dramatic response percentages on either side of the scale, and that can drive some interest.

Tips on Getting Noticed

According to Sean, the first thing you have to do as an entrepreneur — once you've defined your position in the market — is do a degree of buyer's journey research. You have to know in what channels your buyers actually exist. Simply mirroring the activity of other verticals, industries, or sectors is just a way to blow money.

This is why it’s important to figure out which channels make sense. If you make high-end custom wood tables, you may find that your buyers are all over Instagram because it’s a highly visual medium.

The problem here isn't so much about people understanding the logical nature behind this; it's more about them letting their egos get in the way. The average entrepreneur goes and gives a bunch of conference talks because they say that they enjoy doing that and that the crowd likes their talk. But if you think about it: Three months later, how many of those people in that room actually called you?

Apart from those, you have to be really smart about looking at the content that you're producing.

Perhaps it’s generating a lot of clicks but it's not generating a lot of leads. Even in this aspect, the average smaller, medium-sized business often has a hard time separating ego gratification brought by being successful volume-wise from the actual leads.

Image from Unsplash

Sean recounted that a couple of years ago, he and his team put together what is called “The Ultimate Conference List.” Though the name itself wasn't so compelling, it contained all the tech conferences you could imagine. And they actually did a good job: The list got a substantial amount of traffic. They were the top link that came up on Google for the “tech conference” search term. But when they looked at Google Analytics, the number of leads that were coming off their Ultimate Tech Conference page was zero.

Though their buyers loved the qualitative nature of their list, it wasn't creating a pathway to tie it to narrowness — to what makes their business unique. The list was simply a valuable resource.

Now, besides being really clear about their position (and lining themselves and their campaigns like pay-per-click and search engine optimisation campaigns to that), they strive to get noticed by podcasting.

Personally, Sean loves the interaction that comes from it. And it’s aligned with his hobbies, which have always involved some form of teaching. But the pragmatic reason is that it’s a great backlink.

Also, it doesn’t take a lot of upfront resources to do it — though it takes time to develop the expertise to be invited on a show. But the actual act of doing it is less than the amount of time you’ll spend doing a big conference press and going through a conference committee.

Screengrab from Cascade Insights

At the end of the day, when choosing a platform to get noticed, you have to have this balance of ‘Where are your buyers?” and “Can I really track, in a very pragmatic way, if it’s turning into business for my company?” You shouldn’t be seduced and mirror the behaviour of other firms.

At Cascade Insights, they also don’t invest a lot in social media.

Almost every new marketer that joins their team tells Sean, at one point or another, that they should invest in social media. He sometimes lets them experiment and it always comes out the same: They don't get any leads from social media.

Over the years, their buyers have been telling them that they don’t look for a market research vendor on social media. It's simply not where they’re going to find a deep signal of competence. They might read their blog, listen to their podcasts, or watch videos that they produced — but they’re not going to go scarf through Twitter looking for their next market research supplier.

What all this shows is the need to be focused. You have to be very pragmatic about where you invest. And if you do that, you're going to get a really good ROI and you're going to bring leads to your business.

To learn more about them and how you can leverage research to get noticed, visit www.cascadeinsights.com.

This article is based on a transcript from my podcast The UnNoticed Entrepreneur, you can listen here.

Cover image by rawpixel.com on Freepik